Trade Receivables Debit or Credit

CU 100 000 because the unconditional right to a payment was created by handing the project over to the customer Credit Contract asset. CU 70 000 because your conditional right created last year turned into trade receivable or the unconditional right and.

Aging Of Accounts And Mailing Statements Accountingcoach

For example the company XYZ Ltd.

. An accounts receivable credit balance is the opposite of a debit balance even though both are included on the balance sheet since only the debit balance will include overpayments on accounts held by customers. 265000 270000 535000. Trade receivables and working capital.

You can see that the transactions which increase the balance of SLCA are debited decrease the balance are. CCredit to allowance for doubtful accounts of 1200. There are a broad range of potential causes of debit balances.

Accounts receivable sometimes called trade receivable is any money that your customers or clients owe you for a service or product they bought on credit. Its called accounts receivable because its money you have the legal right to receive in your revenue. The goods or services are delivered first and the payment proceeds later.

Definition of Trade Receivables and Other Receivables. Account receivable is the amount the company owes from the customer for selling its goods or services. Trade receivables arise when a business makes sales or provides a service on credit.

Sales Ledger Control Account for the year 0101202 to 3112202 will be presented as follows-. Trade receivables consist of Debtors and Bills Receivables. Once the customer has paid the bill the company will credit the trade receivables account by 475 and debit the cash account.

Below are possible audit procedures for auditing trade receivables. Most companies cannot operate without the application of some form of accounts receivable credit balance in its balance sheet flowing. A companys trade receivables or accounts receivable is an important consideration when it comes to calculating working capital.

ACredit to allowance for doubtful accounts of 1100. C 52Following the completion of an aging analysis the accountant for Liberty estimated that 1100 of the receivables would be uncollectible. Working capital is calculated as current assets minus current liabilities with.

For example if Ben sells goods on credit to Candar Candar will take delivery of the goods and receive an invoice from Ben. Trade Receivables Debtors Bills Receivables Example Trade Receivables. They are treated as an asset to the company and can be found on the balance sheet.

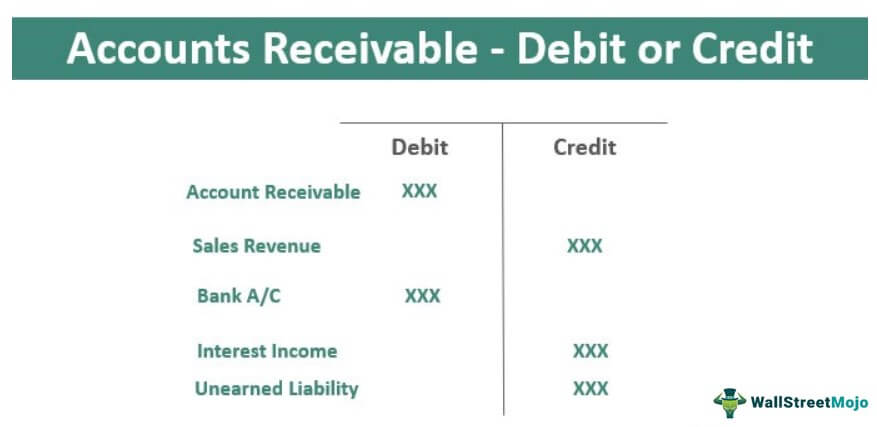

Review the increasing or decreasing trend of the receivables with previous accounting periods. The journal entry to record such credit sales of goods and services is passed by debiting the accounts receivable account with the corresponding credit to the Sales account. In this case the company can make the journal entry of the written-off receivables under the direct write off method as below.

535000 is equal to the sum of the balance of individual outstanding debtors ie. During the ordinary course of business several different transactions are extended on credit by the company. The balance of SLCA ie.

Trade receivables arise due to credit sales. DDebit to bad debt expense of 1000. Calculate trade receivables from the below balance sheet.

Obtain a schedule of provision for bad and doubtful debts broken down into party-wise provisions. Decides to write off accounts receivable of Mr. Financial Accounting FA Technical articles.

This will state how much must be paid for the goods and the. Trade receivable and Other Receivables are some of the primarily Current Asset items in the Financial Statements. Overview of Accounts Receivable Journal.

Put simply a debit balance is an amount that is owed to you by a vendor. Yes in addition to credit balances you may also encounter debit balances. Z that has a balance of USD 300.

For example you may have purchased materials from a vendor but after receiving the materials found that they were defective in some way. This money can be from goods they put on their store accounts or from any unpaid invoices for services. BDebit to bad debt expense of 900.

Trade receivables and revenue. Obtain a list of trade receivables party-wise balances and their respective ageing.

Accounts Receivable Debit Or Credit Top Examples Treatment In Ifrs

Writing Off An Account Under The Allowance Method Accountingcoach

Accounts Receivable Nonprofit Accounting Basics

Accounts Receivable Debit Or Credit Top Examples Treatment In Ifrs

No comments for "Trade Receivables Debit or Credit"

Post a Comment